Venture capital is one of the most sought-after funding options for businesses. The process of obtaining VC is frequently lengthy and difficult, so it's best to have a firm grasp on it before diving in.

We've done the groundwork for you and created an e-book called "How to Get VC Funding" that walks you through the process from beginning to end, with first-timers in mind. This free resource is a must-read for every entrepreneur seeking VC investment. The most important insights from the e-book are highlighted here.

1. Become acquainted with early-stage venture finance.

"Funds flowing into a company in the form of an investment rather than a loan, typically during the pre-IPO process." These investments need a high rate of return and are secured by a considerable ownership stake in the firm and are controlled by an individual or small group known as venture capitalists (VCs)."

In its most basic form, venture capital firms make investments in startups in exchange for stock in the company, with the goal of seeing a good return on their investment. The majority of VC funding comes from institutional and individual investors. These VC investments are often long-term relationships between enterprises and venture capital firms.

2. Determine if your organization is ready to seek VC funding.

For each firm, the best time to contact VCs for funding is different. While it is possible to attract a VC partner with only a concept, the majority of agreements are concluded if a company has three solid items:

- A founding group

- Customers want a minimal viable product (MVP).

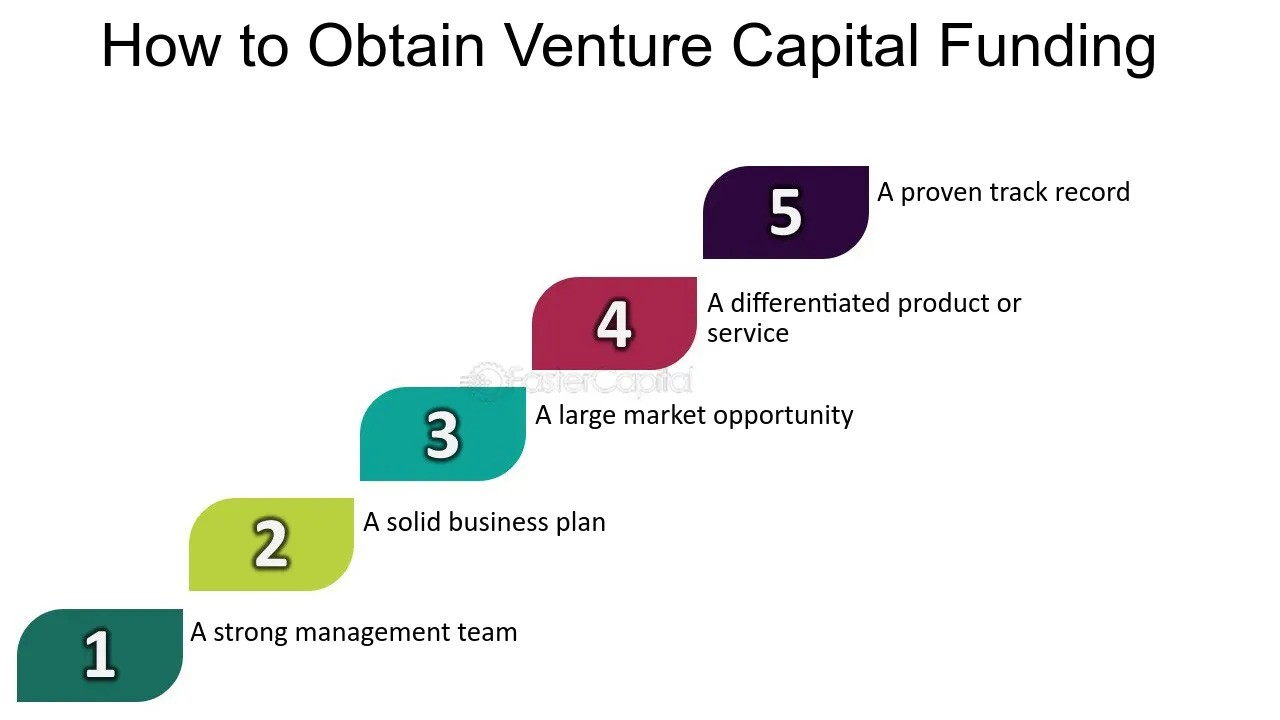

VC is intended for firms with high launch expenses that are meant to develop rapidly. To have the greatest chance of receiving venture capital money, you must have an innovative concept — preferably in a sector where VCs spend substantially, such as technology — and a strong management team.

3. Create a pitch deck and presentation.

If you want to raise money from a venture capitalist, a strong pitch deck will be your calling card and the beginning point for most first encounters.

A pitch deck is a presentation that gives a high-level summary of your company. The presentation might include information on your product or service, business strategy, market potential, company financial requirements, and management team.

- A pitch deck should be brief and succinct, and it should have the following elements:

- Management group

- Market problem and solution

- Company progress Investment amount Financials of the company

4. Find the suitable venture capitalist to support your company.

All venture capital firms have a distinct concentration in terms of the businesses they fund: they may invest primarily in software, consumer goods, fintech, green technology, AI, or any other industry. And each company focuses on distinct investment phases (seed, early-stage, Series A, Series B, Series C, and so on). Thus, research is the initial step in approaching VCs.

Once you've narrowed down your list of potential VCs, it's time to schedule meetings. You have two options for making contacts: an introduction from someone in your network or a cold email to a VC partner.

5. Understand the VC term sheet.

According to the definition, a term sheet is "a non-binding listing of preliminary terms for venture capital financing."It is, according to CB Insights, "the first real piece of paper a founder sees from a VC when they decide that they're interested in investing."

A terms sheet is divided into three sections:

- The financing section outlines the proposed investment's financial parameters.

- It specifies how much money the VC firm is willing to spend and what it expects in return from your startup.

- The primary goal of the corporate governance section is to describe the power allocation between founders and investors in relation to firm decisions.

- The section on liquidation and exit explains what will happen to investors and shareholders if your firm is liquidated, dissolved, or sold.

- It specifies who gets paid first and indicates any special preferences expressed by investors.

6. Complete due diligence and finalize the transaction.

As a founder, you may improve your chances of landing a VC transaction by properly preparing for due diligence, which is the process by which investors "gather necessary information on the actual or potential risks involved in an investment." You may also get acquainted with the reasons why agreements often fail and take proactive efforts to support a closure.

The last step of a venture capital fundraising transaction is the time to achieve alignment among your internal teams, the VC firm, and your legal experts. During this period, entrepreneurs should keep their promises to investors and offer truthful information about their businesses.