Venture capital doesn't always have to be money. In fact, it often comes as technical or managerial expertise. VC is typically allocated to small companies with exceptional growth potential or to those that grow quickly and appear poised to continue to expand.

What Is Venture Capital (VC)?

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions. Venture capital doesn't always have to be money. In fact, it often comes as technical or managerial expertise. VC is typically allocated to small companies with exceptional growth potential or to those that grow quickly and appear poised to continue to expand.

Learning About Venture Capital (VC)

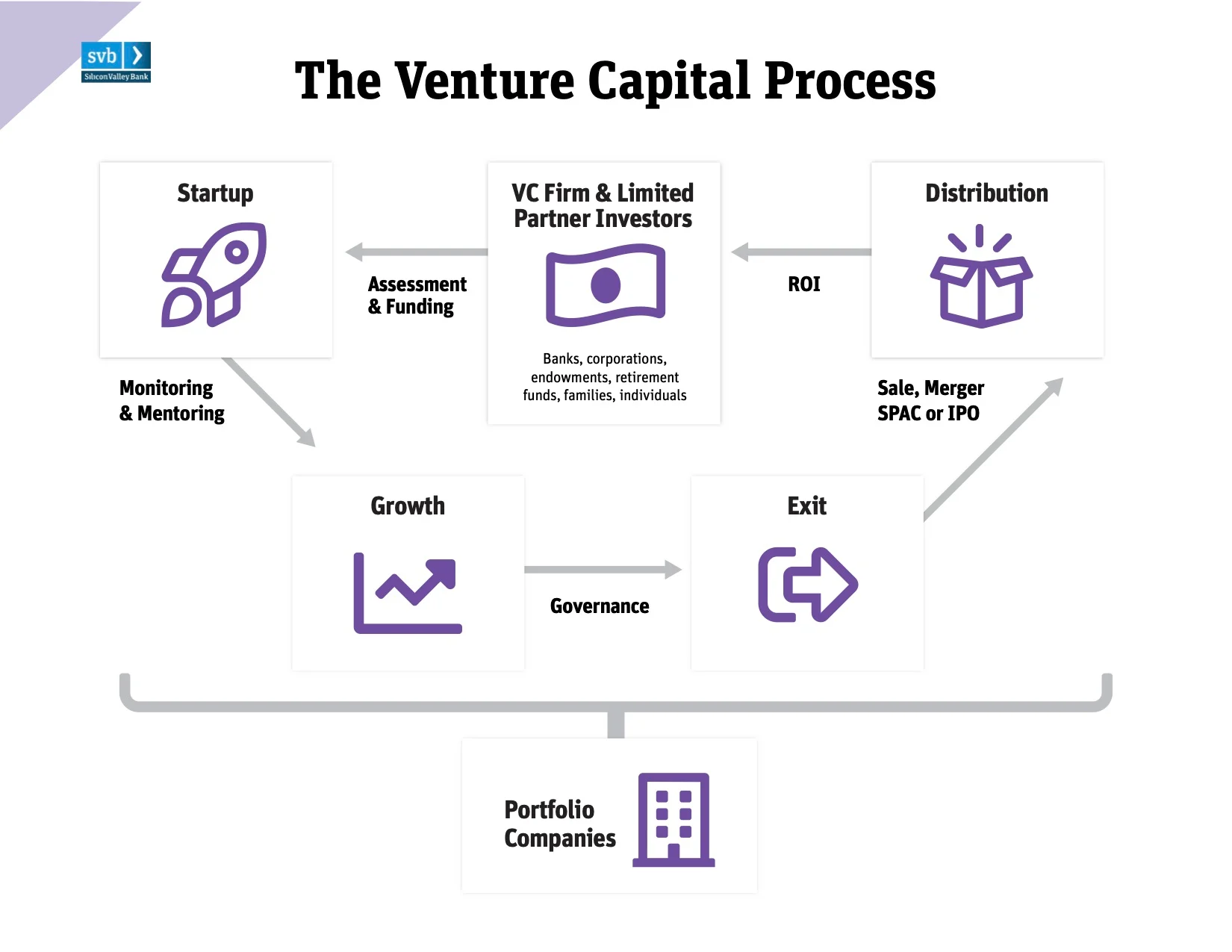

As previously stated, venture capital (VC) funds startups and small businesses that investors feel have significant growth potential. Financing is usually in the form of private equity (PE), but it may also be in the form of knowledge, such as technical or management experience.

VC transactions often entail the formation of huge ownership stakes in a firm, which are then sold to a few investors via separate limited partnerships. These connections are formed by venture capital companies and may include a grouping of multiple related businesses.

However, one significant difference between venture capital and other private equity deals is that venture capital focuses on emerging companies seeking significant funds for the first time, whereas PE focuses on larger, more established companies seeking an equity infusion or the opportunity for company founders to transfer some of their ownership stakes.

Despite the risk, the prospect for above-average profits generally draws venture capitalists. For young enterprises or projects with little operational experience (less than two years), venture capital is becoming a popular and necessary source of finance, particularly if they lack access to capital markets, bank loans, or other debt instruments.2The biggest disadvantage is that investors often get shares in the firm and consequently a vote in corporate decisions.

Venture Capital's History

Private equity includes venture capital. While the foundations of PE may be traced back to the nineteenth century, VC did not emerge as an industry until after World War II.

Georges Doriot, a Harvard Business School professor, is often regarded as the "Father of Venture Capital." In 1946, he founded the American Research and Development Corporation and funded $3.58 million to invest in firms that exploited WWII technology.31

The corporation's initial investment was in a business that hoped to employ x-ray technology to cure cancer. Doriot's $200,000 investment grew to $1.8 million when the business went public in 1955.1

The Financial Crisis of 2007-2008

The 2007-2008 financial crisis had an influence on the venture capital business. Venture capitalists and other institutional investors, who were a vital source of finance for many startups and small businesses, tightened their belts.4

With the appearance of the unicorn after the conclusion of the Great Recession, things changed. A unicorn is a private startup with a valuation of more than $1 billion.5These enterprises started to attract a diversified pool of investors seeking high returns in a low-interest-rate environment, such as sovereign wealth funds (SWFs) and significant private equity firms. Their presence altered the venture capital environment.6

Western Expansion

Although it was primarily backed by banks in the Northeast, VC became more focused on the West Coast as the tech sector grew. Fairchild Semiconductor, founded by eight engineers (the "traitorous eight") from William Shockley's Semiconductor Laboratory, is often regarded as the first technological firm to attract venture capital backing. Sherman Fairchild of Fairchild Camera & Instrument Corp.7, an east coast businessman, supported it.

Arthur Rock, an investment banker with Hayden, Stone & Co. in New York City, assisted in the transaction and later founded one of Silicon Valley's early venture capital companies. Davis & Rock provided funding to some of the most powerful technological businesses, including Intel and Apple.7By 1992, the West Coast had received 48% of all investment funds, while the Northeast had received just 20%.8

The situation hasn't altered much, according to Pitchbook and the National Venture Capital Association. During 2022, West Coast firms accounted for more than 37% of all transactions (but only about 48% of deal value), while the Mid-Atlantic area saw just about 24% of all agreements (and only about 18% of all deal value).9

Regulations Can Assist You

A succession of regulatory changes helped to promote venture capital as a financing source:

The first was a modification to the Small Business Investment Act (SBIC) in 1958. It promoted the venture capital business by offering tax incentives to investors. The Revenue Act was revised in 1978 to cut the capital gains tax from 49% to 28%.11

The Employee Retirement Income Security Act (ERISA) was amended in 1979 to enable pension funds to invest up to 10% of their assets in small or innovative firms.12This action resulted in a surge of investments from wealthy pension funds.13

In 1981, the capital gains tax was cut to 20%.14

These three breakthroughs accelerated the rise of venture capital, and the 1980s became a boom time for venture capital, with financing levels reaching $4.9 billion in 1987.13The business was also thrown into sharp light during the dot-com boom, as venture investors sought speedy profits from highly valued online firms.

Some estimates place investment levels during that time period as high as $30 billion.15However, the expected rewards did not materialize as numerous publicly traded online businesses with lofty values went bankrupt.

.jpg)