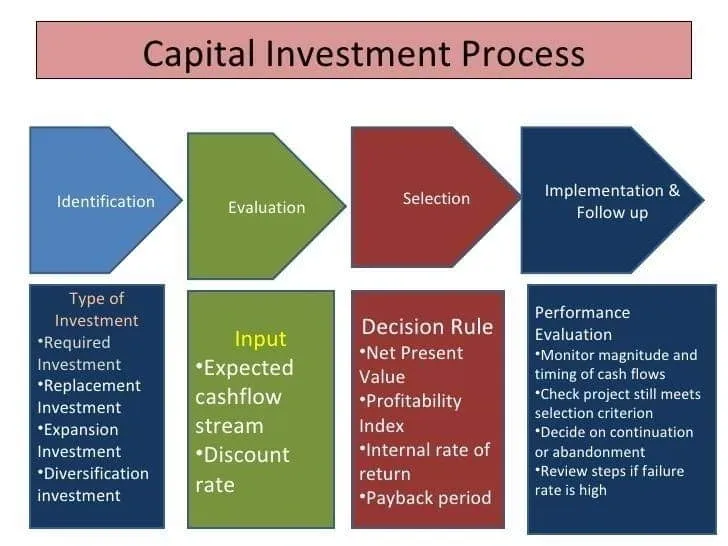

What Is Capital Investment Analysis?

Capital investment analysis is a budgeting process used by businesses and government organizations to determine the potential profitability of a long-term investment.Capital investment analysis evaluates long-term investments, including fixed assets like equipment, machinery, or real estate. The purpose of this method is to determine which option will provide the maximum return on invested cash. Businesses may use a variety of methodologies to undertake capital investment research, including evaluating the estimated value of future cash flows from the project, financing costs, and the project's risk-return.

Understanding Capital Investment Analysis

Because they require big upfront expenditures on assets that are expected to be used for a number of years, capital investments are considered to be hazardous because it will take a considerable amount of time for those assets to pay for themselves. An investment return that is higher than the hurdle rate, also known as the needed rate of return, for shareholders of the company is one of the fundamental conditions that a company must meet in order to evaluate a capital project appropriately.

Net Present Value

The net present value (NPV) model is a popular statistic for capital investment research. It calculates the current value of a project's predicted income, often known as future cash flows. The net present value indicates whether future cash flows or income are sufficient to pay the project's original investment and any subsequent financial outflows.

The NPV calculation discounts--or reduces--expected future cash flows by a certain rate to determine their worth in today's terms. After reducing the initial investment cost from the present value of the predicted cash flows, a project manager may decide if the project is worthwhile. If the NPV is positive, it signifies the project is worthwhile, but a negative NPV indicates that the future cash flows aren't creating enough return to justify the original investment.

Net present value (NPV) is the difference between the present value of a project's cash inflows and costs/outflows. For example, a firm may compare the profits from a project versus the cost of funding that investment. The financing cost would be the hurdle rate used to assess the cash flows' present value. A project is not worth pursuing if the predicted cash flows are insufficient to pay the hurdle rate and the initial investment cost.

Discounted Cash Flow (DCF)

Discounted cash flow (DCF) is similar to net present value but also slightly different. NPV calculates the present value of cash flows and subtracts the initial investment. DCF analysis is essentially a component of the NPV calculation since it's the process of using a discount rate or an alternative rate of return to measure whether the future cash flows make the investment worth it or not.

DCF is popular with investments that are expected to generate a set rate of return each year in the future. It doesn't take into account any start-up costs but merely measures whether the rate of return on the expected future cash flows is worth investing in based on the discount rate used in the formula.

With DCF analysis, the discount rate is typically the rate of return that's considered risk-free and represents the alternative investment of the project. For example, a U.S. Treasury bond is typically considered risk-free since Treasuries are backed by the U.S. government. If a Treasury paid 2% interest, the project would need to earn more than 2%–or the discount rate–to be worth the risk.

The present value is the value of the expected cash flows in today's dollars by discounting or subtracting the discount rate. If the result or present value of the cash flows is greater than the rate of return from the discount rate, the investment is worth pursuing.

Special Considerations

Capital investment choices are not taken carelessly. Analytical models are simple to put up. However, the inputs drive model outputs; hence, appropriate assumptions are crucial in deciding whether a proposed investment will proceed. Cash flows beyond three or five years might be difficult to forecast. When applied to future years, the discount rate has a significant influence on present value calculations.

Sensitivity analysis, which involves plugging different inputs into the model to measure changes in value, should be undertaken. Even yet, unforeseen occurrences may throw off the best-designed model with the most logical assumptions, prompting the modeler to include contingency considerations in the study.