A product recall, natural calamity, litigation, or new government rule might knock your business to its knees. That is a significant milestone for a small firm. That is someone's livelihood, and there might be hundreds of people involved.For enterprise organizations, the risks are considerably higher. Potential dangers may result in the loss of hundreds or thousands of employment, supply challenges for customers, and even economic downturns.

In this post, we'll define risk management, explain why it's important for enterprise firms, and show you how Monday.com can help you stay two steps ahead of major threats.

What is enterprise risk management?

In technical words, enterprise risk management (ERM) detects, monitors, and prepares for possible risk events that might prohibit a business from meeting its strategic goals.In layman's words, enterprise risk management makes it simple to identify issues before they occur and devise a strategy to avoid them or at least mitigate the damage when they do.

Without it, you're fighting blind, with little to no ability to anticipate future roadblocks that may or may not have a significant influence on your everyday operations.

Developing a flawless corporate risk management strategy entails recognizing, analyzing, and preparing for probable risk occurrences or compliance difficulties. It also entails taking action as needed and monitoring hazards both short-term and long term.

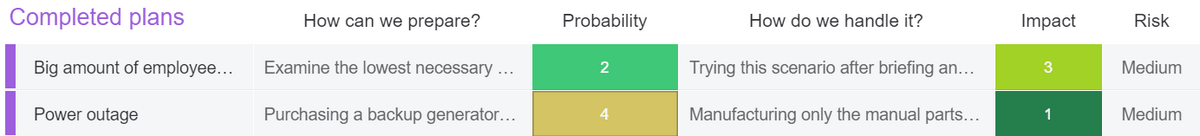

Developing a failsafe risk management strategy involves determining appropriate risk responses, such as accepting, avoiding, terminating, sharing, or minimizing risk. Each has its own use and is suitable in certain situations.

Why is risk management important?

Enterprise risk management matters because, without it, you’re vulnerable as an organization. Some key benefits of risk management include:

- Increased operational efficiency and effectiveness, which means you can do more with less.

- Tighter legal, reporting, and regulatory compliance, which means fewer operational costs, lawsuits, or fines.

- Greater confidence in reaching strategic objectives, which means greater profit or market share.

- Improved awareness of potential risks, which enhances the organization’s ability to respond appropriately.

A solid risk management process establishes the structure for risk identification, awareness, and monitoring. The advantages greatly exceed the expenditures, and risk management software solutions like as Monday.com make it simple to keep track of everything.

But how do enterprise-level hazards compare to others?Enterprise risk management is particularly critical given the disconnect between CEOs and senior leaders and their frontline staff.The common thread here is that those at the top think everything looks fantastic. Their high-level metrics seem to be positive, and the reports they get from younger leaders often include information that they want to hear.

How to manage risk at the enterprise level

Enterprise risk management identifies potential obstacles to attaining strategic objectives. It is about ensuring that those at the top can cut through the noise, get the information they need, and make better educated choices.

But how does it play out on a daily basis?

Enterprise risk management begins with top management providing the advice, support, tools, expertise, and resources required to identify possible risk factors.

Without all of this, any attempt to manage risks or stay compliant would most likely die out or fail entirely. At the company level, there is an overall plan, yet each department or division will promote its own competing strategy.

If there is any misunderstanding or lack of communication among these important company participants, you expose yourself to possible danger.

The only way to get ahead of all of this is to implement an enterprise risk management system.

If every area of the organization utilizes the same technology, risk may be managed at the enterprise level. Monday.com is such a solution, but the software is only as good as the process you include into it.

How to implement your own enterprise risk management process

The enterprise risk management strategy you deploy comes down to the individual processes and systems you create. Ideally, you have one with automation and plenty of checks and balances.

Here are the key steps to implementing one:

Capture potential risk items right away

- Truly managing risk starts and ends with a good risk assessment. It’s not something you do once, but constantly.

- The landscape is constantly changing as new technologies emerge, new laws come into play, and the economy fluctuates.

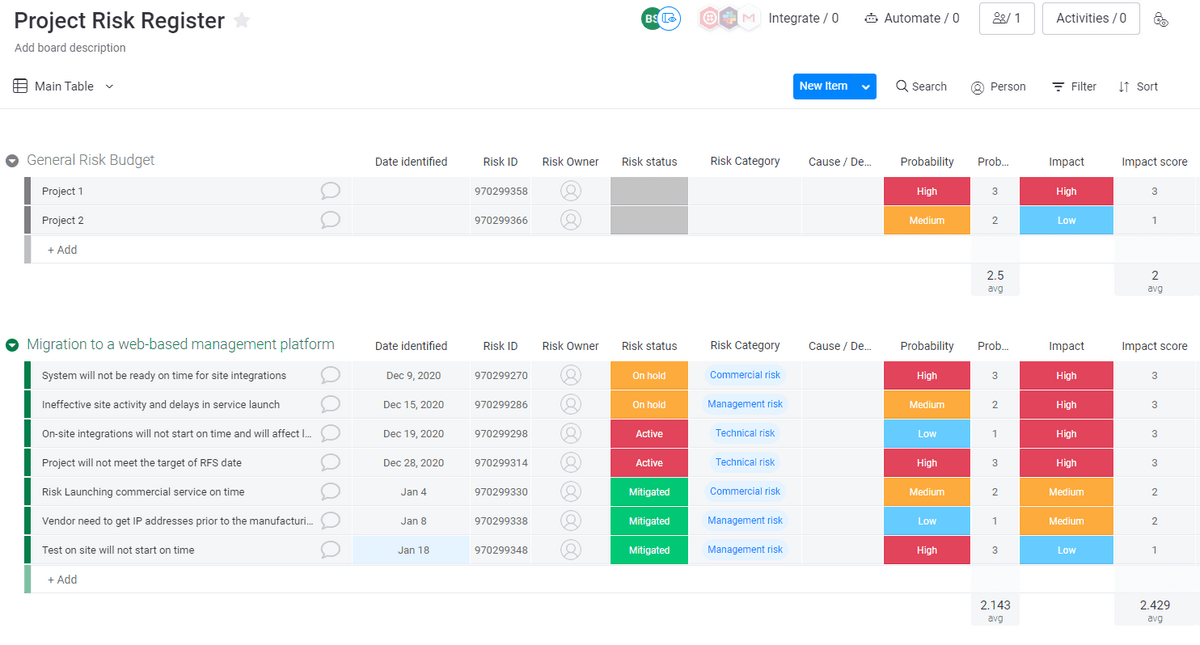

- Before you begin, you’ll need to find a way to log these risk items. Here’s where setting up a risk register in monday.com comes in handy.

What are the different types of risk, you ask? It’ll vary by industry, but common risk domains include:

- Operational risk such as failed internal processes and systems.

- Strategic risks like potential acquisitions or mergers.

- Financial risks from costs related to litigation, insurance payouts, or foreign exchange rate changes.

- Human capital risks such as turnover, burnout, or strikes.

- Technological risks like data breaches or data loss.

- Hazards like natural disasters.

The potential for risk is everywhere and is constantly changing. Only through proper logging and tracking do you have a chance of keeping up.